Bagi mereka yang dah lama menanti nak beli emas, waktu ni dirasakan agak sesuai membeli. Mungkin harga akan turun sedikit lagi selepas ini, tetapi jika membeli sekarang pun tiada ruginya. Harga emas ketika ini jatuh ke USD 1740 seounce. Kalau dapat beli atas tangan orang dengan harga bawah market price lebih baik.

Saya rasa waktu paling sesuai lock emas bagi yang nak membeli ialah ketika harga menjadi USD 1700 seounce ke bawah atau untuk Public Gold 20g, RM 3600 ke bawah. Ini pendapat saya. Terpulang pada pembaca tentukan sendiri.

Selamat memantau harga emas.

Abu Bakar Ibn Abi Maryam melaporkan bahawa beliau mendengar RASULULLAH SAW telah bersabda; Akan tiba suatu zaman di mana tiada apa yang bernilai dan boleh digunakan oleh umat manusia. Maka simpanlah dinar dan dirham. Musnad Imam Ahmad Ibn Hanbal.

Wednesday, August 24, 2011

Monday, August 22, 2011

Emas Naik Melepasi USD 1900

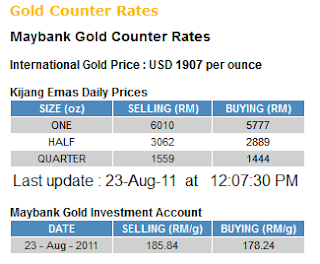

Seperti dijangka, emas naik melebihi USD 1900 seounce pagi tadi. Harga Kijang emas hari ini disandarkan ketika emas berharga USD 1907 seounce iaitu RM 6010. Bayangkan pada bulan 12, hargannya sekitar RM 4500. Sesiapa yang beli Kijang emas sekitar bulan Februari 2011 lah yang paling banyak untung. Untung bersih selepas tolak spread sudah melebihi 30 % tidak sampai setahun. Inilah namanya rezeki penyimpan emas.

Emas Naik Lagi Menghampiri USD 1900 !!!

Sejak hampir setahun saya menyimpan emas, kali inilah saya rasa emas betul-betul naik dengan amat pantas. Kalau ini berterusan, saya rasa satu masa nanti agak sukar untuk golongan pertengahan membeli emas kerana harganya yang sangat mahal. Rasanya sekarang ni gelang emas biasa pun mungkin harganya sekitar RM 6000 ! bayangkan.

Kenaikan kali ini disebabkan krisis hutang Eropah yang terus menerus tidak nampak pulihnya dan prestasi ekonomi yang lembap di seluruh dunia. Jika kita tengok Bloomberg atau CNBC Asia pun asyik cerita pasal saham yang jatuh di seluruh dunia. Harga minyak pun turun tapi harga minyak di Malaysia tak turun2.

Setiap kali berlaku kejatuhan ekonomi, harga emas akan meningkat naik kerana sebenarnya nilai emas sama, cuma nilai mata wang saja yang makin jatuh.

Kenaikan tahunan amat tinggi iaitu melebihi 50 %. jauh lagi tinggi daripada kenaikan purata sekitar 27-30%. Waktu ni sesuai menjual atau terus menyimpan. Jika nak beli, cadangan saya sama ada tunggu bila berlaku penurunan sementara selepas ini atau beli atas tangan orang dengan harga di bawah pasaran.

Harga perak juga nampak makin naik. Cuma harga perak dikatakan agak volatile iaitu mudah naik dan turun. Tapi tak rugi menyimpan seperti yang dianjurkan oleh Rasulullah SAW. Yakinlah. Tapi jangan lupa bayar zakat ye... Bertambah berkat simpanan kita , insya Allah.

Gold rallied for a sixth day to an all-time high as a global economic slowdown and the European debt crisis boosted demand for a haven. Platinum climbed to the highest level in more than three years.

Immediate-delivery bullion gained as much as 1.6 percent to $1,882.55 an ounce, and traded at $1,881.50 at 2:14 p.m. in Singapore. The metal is up 16 percent in August, heading for its best monthly performance since September 1999.

“Gold has support given the risks are still there, so I wouldn’t want to short gold in the current environment,” said Jeremy Friesen, commodity strategist at Societe Generale SA. So- called short sales refer to bets on declines in prices.

The Standard & Poor’s 500 Index capped its biggest four- week loss since 2009 last week on concern German Chancellor Angela Merkel’s resistance to common euro-area bonds will prolong the region’s debt crisis. Central bankers from around the world will meet in Jackson Hole, Wyoming this week amid speculation Federal Reserve Chairman Ben S. Bernanke may signal a third-round of asset purchases to boost the faltering recovery.

December-delivery gold rose as much as 1.8 percent to a record $1,885.90 an ounce. Bullion priced in sterling advanced to an all-time high, while June-delivery gold on the Tokyo Commodity Exchange and December-delivery metal on the Shanghai Futures Exchange climbed to their highest ever. Futures on the Multi Commodity Exchange of India Ltd. also reached a record.

Kenaikan kali ini disebabkan krisis hutang Eropah yang terus menerus tidak nampak pulihnya dan prestasi ekonomi yang lembap di seluruh dunia. Jika kita tengok Bloomberg atau CNBC Asia pun asyik cerita pasal saham yang jatuh di seluruh dunia. Harga minyak pun turun tapi harga minyak di Malaysia tak turun2.

Setiap kali berlaku kejatuhan ekonomi, harga emas akan meningkat naik kerana sebenarnya nilai emas sama, cuma nilai mata wang saja yang makin jatuh.

Kenaikan tahunan amat tinggi iaitu melebihi 50 %. jauh lagi tinggi daripada kenaikan purata sekitar 27-30%. Waktu ni sesuai menjual atau terus menyimpan. Jika nak beli, cadangan saya sama ada tunggu bila berlaku penurunan sementara selepas ini atau beli atas tangan orang dengan harga di bawah pasaran.

Harga perak juga nampak makin naik. Cuma harga perak dikatakan agak volatile iaitu mudah naik dan turun. Tapi tak rugi menyimpan seperti yang dianjurkan oleh Rasulullah SAW. Yakinlah. Tapi jangan lupa bayar zakat ye... Bertambah berkat simpanan kita , insya Allah.

Gold Advances to Record, Platinum to 3-Year High, Silver to 3-Month Peak

Gold rallied for a sixth day to an all-time high as a global economic slowdown and the European debt crisis boosted demand for a haven. Platinum climbed to the highest level in more than three years.

Immediate-delivery bullion gained as much as 1.6 percent to $1,882.55 an ounce, and traded at $1,881.50 at 2:14 p.m. in Singapore. The metal is up 16 percent in August, heading for its best monthly performance since September 1999.

“Gold has support given the risks are still there, so I wouldn’t want to short gold in the current environment,” said Jeremy Friesen, commodity strategist at Societe Generale SA. So- called short sales refer to bets on declines in prices.

The Standard & Poor’s 500 Index capped its biggest four- week loss since 2009 last week on concern German Chancellor Angela Merkel’s resistance to common euro-area bonds will prolong the region’s debt crisis. Central bankers from around the world will meet in Jackson Hole, Wyoming this week amid speculation Federal Reserve Chairman Ben S. Bernanke may signal a third-round of asset purchases to boost the faltering recovery.

December-delivery gold rose as much as 1.8 percent to a record $1,885.90 an ounce. Bullion priced in sterling advanced to an all-time high, while June-delivery gold on the Tokyo Commodity Exchange and December-delivery metal on the Shanghai Futures Exchange climbed to their highest ever. Futures on the Multi Commodity Exchange of India Ltd. also reached a record.

Thursday, August 18, 2011

Emas catat rekod lagi USD 1825 !

Emas catat rekod lagi. Kali ni dikaitkan dengan krisis hutang Eropah yang makin meruncing serta kejatuhan pasaran saham seluruh dunia menyebabkan pelabur mengalih pelaburan mereka kepada emas yang terbukti lebih selamat. Kita bila lagi ?

Begitulah kelaziman emas. Setiap kali saham dunia jatuh, harga naik. Duit USA jatuh, harga naik. Hutang Eropah makin teruk, harga naik. Jadi kesimpulannya bagi penyimpan emas, jika berlaku perkara-perkara yang disebutkan tadi, mereka akan tersenyum...

Comex Gold Sharply, Hits New Record High, amid EU Debt Worries

(Kitco News) -Comex gold futures prices are trading sharply higher Thursday morning and have established another all-time record high of $1,819.90 an ounce as of this writing. Once again investor risk appetite has pulled back as the world stock markets are selling off Thursday, due to more European Union debt concerns. That's prompting fresh safe-haven demand for gold. December gold last traded up $22.70 at $1,816.60 an ounce. Spot gold last traded up $24.10 an ounce at $1,813.75. December Comex silver last traded up $0.067 at $40.445 an ounce.

The European Union debt crisis remains a major bullish fundamental factor for the gold market. European financial stocks sold off sharply overnight and gold rallied. Tuesday's meeting between French President Nicolas Sarkozy and German Chancellor Angela Merkel, who discussed what to do about the debt crisis, left traders and investors nonplussed. The EU debt saga drags on with no end in sight.

The market place continues to look to the U.S. stock market and its daily movements. The daily price moves in the U.S. stock indexes continue to be the gauge for measuring investor risk appetite in the market place. And Thursday, investors have pulled in their horns and are seeking perceived safer assets.

The U.S. dollar index is trading firmer Thursday morning on short covering in a bear market. The greenback bulls have faded again this week. Currency and financial markets are also awaiting some U.S. inflation and other key U.S. economic data due out Thursday morning.

Crude oil prices are trading solidly lower Thursday morning on the EU debt woes and slumping stock markets. However, recent price action hints the crude oil market has put in a near-term bottom. Look for choppy and sideways trading in crude oil in the coming weeks. The crude oil market will continue to be a major "outside market" force for the precious metals.

In an interview on CNBC Wednesday, widely followed newsletter writer Dennis Gartman said gold is not a safe-haven investment asset because its price is too volatile on a daily basis. Although I respect Gartman's work, he's off base on that matter. A market's or asset's perceived safe-have status has nothing to do with its daily price volatility. It's a sound notion that the vast majority of investment demand for gold is based upon the idea that gold is a safer store of value during very uncertain economic times and amid gyrating currency, stock and financial markets.

U.S. economic data due for release Thursday includes the weekly jobless claims report, the consumer price index, leading economic indicators, existing home sales and the Philadelphia Fed business survey.

The London A.M. gold fixing was $1,794.50 versus the previous P.M. fixing of $1,790.00.

Technically, gold futures bulls have the strong overall near-term and longer-term technical advantage and are gaining near-term upside technical momentum this week. Bulls' next near-term upside technical objective is to produce a close above solid technical resistance at $1,850.00. Bears' next near-term downside price objective is closing prices below psychological support at the last "reaction low" on the daily bar chart, at $1,725.80. First resistance is seen at $1,825.00 and then at $1,850.00. First support is seen at $1,800.00 and then at the overnight low of $1,786.80.

Technically, silver bulls still have the overall near-term technical advantage. Bulls are regaining some upside technical momentum this week. However, the silver bulls are not nearly in the powerfully bullish technical posture that gold now possesses. Silver bulls' next upside price objective is producing a close above solid technical resistance at the August high of $42.31 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at the August low of $37.055. First resistance is seen at Wednesday's high of $40.63 and then at $41.00. Next support is seen at Thursday's low of $40.11 and then at $40.00.

Begitulah kelaziman emas. Setiap kali saham dunia jatuh, harga naik. Duit USA jatuh, harga naik. Hutang Eropah makin teruk, harga naik. Jadi kesimpulannya bagi penyimpan emas, jika berlaku perkara-perkara yang disebutkan tadi, mereka akan tersenyum...

Tengok sajalah jadual Kitco di atas. Kenaikan tahunan sudah hampir 50% !!! Maknanya jika kita beli emas RM 3000 tahun lepas (18 Ogos 2010) , kini harganya sudah hampir RM 4500 !! Untung RM 1500. Bayangkan.

Apa lagi. Mari membeli dan menyimpan emas. Jangan tunggu naik lagi. Tapi jika nak dapat harga di bawah market price, cuba tengok di Facebook Public Gold.

Comex Gold Sharply, Hits New Record High, amid EU Debt Worries

(Kitco News) -Comex gold futures prices are trading sharply higher Thursday morning and have established another all-time record high of $1,819.90 an ounce as of this writing. Once again investor risk appetite has pulled back as the world stock markets are selling off Thursday, due to more European Union debt concerns. That's prompting fresh safe-haven demand for gold. December gold last traded up $22.70 at $1,816.60 an ounce. Spot gold last traded up $24.10 an ounce at $1,813.75. December Comex silver last traded up $0.067 at $40.445 an ounce.

The European Union debt crisis remains a major bullish fundamental factor for the gold market. European financial stocks sold off sharply overnight and gold rallied. Tuesday's meeting between French President Nicolas Sarkozy and German Chancellor Angela Merkel, who discussed what to do about the debt crisis, left traders and investors nonplussed. The EU debt saga drags on with no end in sight.

The market place continues to look to the U.S. stock market and its daily movements. The daily price moves in the U.S. stock indexes continue to be the gauge for measuring investor risk appetite in the market place. And Thursday, investors have pulled in their horns and are seeking perceived safer assets.

The U.S. dollar index is trading firmer Thursday morning on short covering in a bear market. The greenback bulls have faded again this week. Currency and financial markets are also awaiting some U.S. inflation and other key U.S. economic data due out Thursday morning.

Crude oil prices are trading solidly lower Thursday morning on the EU debt woes and slumping stock markets. However, recent price action hints the crude oil market has put in a near-term bottom. Look for choppy and sideways trading in crude oil in the coming weeks. The crude oil market will continue to be a major "outside market" force for the precious metals.

In an interview on CNBC Wednesday, widely followed newsletter writer Dennis Gartman said gold is not a safe-haven investment asset because its price is too volatile on a daily basis. Although I respect Gartman's work, he's off base on that matter. A market's or asset's perceived safe-have status has nothing to do with its daily price volatility. It's a sound notion that the vast majority of investment demand for gold is based upon the idea that gold is a safer store of value during very uncertain economic times and amid gyrating currency, stock and financial markets.

U.S. economic data due for release Thursday includes the weekly jobless claims report, the consumer price index, leading economic indicators, existing home sales and the Philadelphia Fed business survey.

The London A.M. gold fixing was $1,794.50 versus the previous P.M. fixing of $1,790.00.

Technically, gold futures bulls have the strong overall near-term and longer-term technical advantage and are gaining near-term upside technical momentum this week. Bulls' next near-term upside technical objective is to produce a close above solid technical resistance at $1,850.00. Bears' next near-term downside price objective is closing prices below psychological support at the last "reaction low" on the daily bar chart, at $1,725.80. First resistance is seen at $1,825.00 and then at $1,850.00. First support is seen at $1,800.00 and then at the overnight low of $1,786.80.

Technically, silver bulls still have the overall near-term technical advantage. Bulls are regaining some upside technical momentum this week. However, the silver bulls are not nearly in the powerfully bullish technical posture that gold now possesses. Silver bulls' next upside price objective is producing a close above solid technical resistance at the August high of $42.31 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at the August low of $37.055. First resistance is seen at Wednesday's high of $40.63 and then at $41.00. Next support is seen at Thursday's low of $40.11 and then at $40.00.

Monday, August 15, 2011

Jangan letak semua telur dalam satu bakul

Berikut adalah satu petikan menarik tentang pelaburan emas. Banyak ilmu yang boleh diperolehi daripada artikel ini. WBP janganlah terima bulat2 semua statement berkenaan. Ambillah mana yang baik dan abaikan mana yang kita tidak setuju.

Pendapat saya, jika ada duit lebih, beli emas. Tapi paling elok pada ketika harga nya menurun sedikit atau ketika berlaku 'correction'. Atau jika ada orang nak jual emas pada kita dengan harga di bawah 'market value', sambar je...

KUALA LUMPUR: Don't put all your eggs in one basket and spend your money wisely, say economists when commenting on whether money should be used to buy gold for investment as prices have been escalating recently.

The price of gold has skyrocketed to RM190 per gramme from RM142 per gramme about a year ago.

Following the drop in the US dollar, consumers are displaying greater confidence in gold which is considered the best investment in view of the US debt crisis.

However, economists say despite its rising cost, gold remains an investment liability.

They cautioned investors not to place all their money in gold, although it may now seem like a sure bet as the price will eventually drop. Instead, the advice is to use the money on properties, food, oil and gas stocks.

Rating Agency Malaysia Berhad's (RAM) group chief economist Dr Yeah Kim Leng said the price of gold is rising because of falling US currency, and it is only natural that people turn to gold as a "safe haven" in such a scenario.

"In times of trouble, gold is always seen as a refuge for investors. It is only natural that people would seek gold and buy it as a substitute for the falling US dollar. While the price of gold may rise further, it is expected to dive when the dollar begins to picks up."

Yeah said the increase in gold prices is due to uncertainty in the market and should not be viewed as a continuous or permanent situation.

"It is better for people to buy oil and gas stocks or assets instead of gold," he said.

Bank Islam Malaysia Berhad's (BIMB) chief economist Azrul Azwa Ahmad Tajudin also warned that what goes up must come down.

"In times like this, investors will buy gold when currencies are down as a means to 'shield' themselves.

"It is common for gold prices to go up during times of an economic slowdown but it is really advisable to invest your money in stocks such as in oil and gas, and food and properties. This is because the market for gold is not fixed and therefore once the currency issue is resolved, we are bound to see a drop in gold prices later on."

Azrul Azwa said even though it is not wrong for investors to buy gold at this time, it would be much wiser if they use it for other things.

"Diversify your portfolio as you don't necessarily have to fix your target on just gold when you can buy other commodities."

Asian Strategy & Leadership Institute (ASLI) director and National Economic Action Council's (NEAC) globalisation committee member Tan Sri Dr Ramon Navaratnam advised potential investors to look to properties instead of gold as it would not give long-term financial returns.

"Do not put all your eggs in one basket. Diversify and look to other assets when looking to invest, such as properties, food or oil and gas. If you only purchase gold, that would be risky."

Ramon said this pertains to all forms of gold, be it Australian nuggets, Emas Kijang, Dinar of even the Canadian Maple Leaf.

"Gold is gold, it does not matter which kind or type, it still gold," he said.

In the US, gold prices pushed to new heights last Tuesday as investors digested the possible consequences of the lowered US credit rating and Europe's debt crisis on a slowing global economy.

Investors view gold as a safer bet amid rising worries about debt levels of the major economies and uncertain stock markets. The value of gold, unlike that of a currency, doesn't hinge on whether countries can make their bond payments, or on the vigour of their economies.

The metal's price has more than doubled since the recession began in late 2007, and its climb accelerated this summer.

Gold is more than a currency substitute or an investment for scared traders desperate to latch onto an asset that is not losing value. It is also a material used in industrial products and by consumers who will now have to pay more for engagement rings, gold crowns for their teeth and perhaps even electronics.

Pendapat saya, jika ada duit lebih, beli emas. Tapi paling elok pada ketika harga nya menurun sedikit atau ketika berlaku 'correction'. Atau jika ada orang nak jual emas pada kita dengan harga di bawah 'market value', sambar je...

Don't invest everything on gold, say economists

KUALA LUMPUR: Don't put all your eggs in one basket and spend your money wisely, say economists when commenting on whether money should be used to buy gold for investment as prices have been escalating recently.

The price of gold has skyrocketed to RM190 per gramme from RM142 per gramme about a year ago.

Following the drop in the US dollar, consumers are displaying greater confidence in gold which is considered the best investment in view of the US debt crisis.

However, economists say despite its rising cost, gold remains an investment liability.

They cautioned investors not to place all their money in gold, although it may now seem like a sure bet as the price will eventually drop. Instead, the advice is to use the money on properties, food, oil and gas stocks.

Rating Agency Malaysia Berhad's (RAM) group chief economist Dr Yeah Kim Leng said the price of gold is rising because of falling US currency, and it is only natural that people turn to gold as a "safe haven" in such a scenario.

"In times of trouble, gold is always seen as a refuge for investors. It is only natural that people would seek gold and buy it as a substitute for the falling US dollar. While the price of gold may rise further, it is expected to dive when the dollar begins to picks up."

Yeah said the increase in gold prices is due to uncertainty in the market and should not be viewed as a continuous or permanent situation.

"It is better for people to buy oil and gas stocks or assets instead of gold," he said.

Bank Islam Malaysia Berhad's (BIMB) chief economist Azrul Azwa Ahmad Tajudin also warned that what goes up must come down.

"In times like this, investors will buy gold when currencies are down as a means to 'shield' themselves.

"It is common for gold prices to go up during times of an economic slowdown but it is really advisable to invest your money in stocks such as in oil and gas, and food and properties. This is because the market for gold is not fixed and therefore once the currency issue is resolved, we are bound to see a drop in gold prices later on."

Azrul Azwa said even though it is not wrong for investors to buy gold at this time, it would be much wiser if they use it for other things.

"Diversify your portfolio as you don't necessarily have to fix your target on just gold when you can buy other commodities."

Asian Strategy & Leadership Institute (ASLI) director and National Economic Action Council's (NEAC) globalisation committee member Tan Sri Dr Ramon Navaratnam advised potential investors to look to properties instead of gold as it would not give long-term financial returns.

"Do not put all your eggs in one basket. Diversify and look to other assets when looking to invest, such as properties, food or oil and gas. If you only purchase gold, that would be risky."

Ramon said this pertains to all forms of gold, be it Australian nuggets, Emas Kijang, Dinar of even the Canadian Maple Leaf.

"Gold is gold, it does not matter which kind or type, it still gold," he said.

In the US, gold prices pushed to new heights last Tuesday as investors digested the possible consequences of the lowered US credit rating and Europe's debt crisis on a slowing global economy.

Investors view gold as a safer bet amid rising worries about debt levels of the major economies and uncertain stock markets. The value of gold, unlike that of a currency, doesn't hinge on whether countries can make their bond payments, or on the vigour of their economies.

The metal's price has more than doubled since the recession began in late 2007, and its climb accelerated this summer.

Gold is more than a currency substitute or an investment for scared traders desperate to latch onto an asset that is not losing value. It is also a material used in industrial products and by consumers who will now have to pay more for engagement rings, gold crowns for their teeth and perhaps even electronics.

Wednesday, August 10, 2011

Harga Emas Naik melebihi 1800 USD !!!

Pada waktu blog ini ditulis, harga emas turun sedikit. Tapi pada pagi tadi ia telah melebihi 1800 USD. Sesiapa yang ada menyimpan kijang emas sudah tentu tersenyum lebar kerana untung yang berlipat kali ganda. Begitu juga dengan pemilik emas Public Gold. Nasihat saya, terus menyimpan emas jika mampu kerana harga nya dijangka naik lagi.

Tengok saja kenaikan tahunan di atas. Sudah berada pada tahap 49.15 % atau 588 USD naik setahun berbanding tahun lepas. Kira-kita RM 1760 setiap ounce.

Cuma jangan lupa bayar zakat ye jika cukup haul setahun dan cukup nisab 85 gram (untuk emas bukan perhiasan).

Tengok saja kenaikan tahunan di atas. Sudah berada pada tahap 49.15 % atau 588 USD naik setahun berbanding tahun lepas. Kira-kita RM 1760 setiap ounce.

Cuma jangan lupa bayar zakat ye jika cukup haul setahun dan cukup nisab 85 gram (untuk emas bukan perhiasan).

Monday, August 8, 2011

Emas Naik Lagi USD 1757

Emas terus naik lagi kerana sentimen pelabur yang membeli emas dengan banyaknya sebagai langkah selamat disebabkan kebimbangan terhadap situasi ekonomi yang tidak menentu di US dan Eropah serta kemungkinan kemelesetan ekonomi global.

Gold for December delivery in New York advanced as much as 3.6 percent to a record $1,774.80 an ounce and traded at $1,759.40 at 2:56 p.m. in Melbourne. Immediate-delivery gold rose as much as 3.1 percent to an all-time high of $1,772.38. Gold was costlier than platinum for the first time since 2008.

The precious metal has surged 23 percent this year, heading for an 11th year of gains, as the global sovereign-debt crisis and a faltering economy boost demand for wealth protection. Gold holdings had their biggest daily advance since May last year as of Aug. 8. John Paulson, who made $15 billion betting against subprime mortgages, is still the biggest investor in the largest exchange-traded fund backed by bullion.

“The market is now worried about another global recession,” Natalie Robertson, a commodity analyst at Australia & New Zealand Banking Group Ltd., said by phone from Melbourne. “The S&P downgrade of the U.S. credit rating has fueled a lot of those concerns and the market is also focusing on the European situation.”

Holdings in exchange-traded products backed by gold surged 1.4 percent to a record 2,216.8 tons on Aug. 8, data compiled by Bloomberg show, an 11th straight gain. Gold futures jumped $61.40, or 3.7 percent, yesterday to settle at $1,713.20 an ounce, the biggest gain since March 19, 2009.

Gold Tops Record $1,750 as Investors Seek Haven

Gold futures exceeded $1,770 an ounce for the first time as the global rout in equities and commodities deepened on concern the economic slowdown will worsen after Standard & Poor’s cut the U.S. credit rating.Gold for December delivery in New York advanced as much as 3.6 percent to a record $1,774.80 an ounce and traded at $1,759.40 at 2:56 p.m. in Melbourne. Immediate-delivery gold rose as much as 3.1 percent to an all-time high of $1,772.38. Gold was costlier than platinum for the first time since 2008.

The precious metal has surged 23 percent this year, heading for an 11th year of gains, as the global sovereign-debt crisis and a faltering economy boost demand for wealth protection. Gold holdings had their biggest daily advance since May last year as of Aug. 8. John Paulson, who made $15 billion betting against subprime mortgages, is still the biggest investor in the largest exchange-traded fund backed by bullion.

“The market is now worried about another global recession,” Natalie Robertson, a commodity analyst at Australia & New Zealand Banking Group Ltd., said by phone from Melbourne. “The S&P downgrade of the U.S. credit rating has fueled a lot of those concerns and the market is also focusing on the European situation.”

Holdings in exchange-traded products backed by gold surged 1.4 percent to a record 2,216.8 tons on Aug. 8, data compiled by Bloomberg show, an 11th straight gain. Gold futures jumped $61.40, or 3.7 percent, yesterday to settle at $1,713.20 an ounce, the biggest gain since March 19, 2009.

Sunday, August 7, 2011

Harga emas naik melonjak lagi ke USD 1696 !!!

Harga emas naik dengan begitu drastik sekali. Posting saya sebelum ni ia naik ke USD 1613. Sekarang USD 1696 !!! Kenaikan kali ini disebabkan sentimen awal pasaran saham yang tidak baik ekoran penurunan US credit rating pada Jumaat lepas dan pengumuman Kesatuan Eropah bahwa krisis hutang mereka semakin serius.

Pendapat saya, waktu ni tidak sesuai membeli kecuali jika beli dari tangan orang dengan harga 'we buy' yang lebih rendah. Paling elok ialah terus menyimpan atau jika ingin pakai duit, elok juga jika menjual ketika ini.

Cuba kita tengok jadual di atas. Kenaikan bulanan sahaja sebanyak USD 154 dollar iaitu 9.97 % !!! Ini amat tinggi. Lebih RM 300 sebulan untuk setiap auns. Kenaikan tahunan jangan cerita : USD 492 atau 40.85 %.!!! Ini melebihi purata kenaikan tahunan sekitar 25-30 % setahun.

Bila waktu sesuai membeli emas ? Saya selalu cadangkan, jika kenaikan bulanan di jadual di atas negatif, dan jika kenaikan tahunan di bawah paras 20%, waktu tu sesuai membeli emas. Itu teori saya.

Jadi, kepada yang ada duit lebih, jangan rasa rugi membeli dan menyimpan emas kerana ia amat menguntungkan. Saya rasa bila2 masa ia boleh naik melebihi USD 1700. Kita tunggu nanti.

Kalau nak tanya pendapat saya, membeli emas Kijang Emas di Maybank dan Public Gold amat menguntungkan berdasarkan pengalaman saya. Cuma mungkin kita boleh tunggu harga turun sedikit selepas ini untuk membeli. Atau jika ada yang nak menjual dengan harga yang murah, apa lagi, sambar je....

Pendapat saya, waktu ni tidak sesuai membeli kecuali jika beli dari tangan orang dengan harga 'we buy' yang lebih rendah. Paling elok ialah terus menyimpan atau jika ingin pakai duit, elok juga jika menjual ketika ini.

Cuba kita tengok jadual di atas. Kenaikan bulanan sahaja sebanyak USD 154 dollar iaitu 9.97 % !!! Ini amat tinggi. Lebih RM 300 sebulan untuk setiap auns. Kenaikan tahunan jangan cerita : USD 492 atau 40.85 %.!!! Ini melebihi purata kenaikan tahunan sekitar 25-30 % setahun.

Bila waktu sesuai membeli emas ? Saya selalu cadangkan, jika kenaikan bulanan di jadual di atas negatif, dan jika kenaikan tahunan di bawah paras 20%, waktu tu sesuai membeli emas. Itu teori saya.

Jadi, kepada yang ada duit lebih, jangan rasa rugi membeli dan menyimpan emas kerana ia amat menguntungkan. Saya rasa bila2 masa ia boleh naik melebihi USD 1700. Kita tunggu nanti.

Kalau nak tanya pendapat saya, membeli emas Kijang Emas di Maybank dan Public Gold amat menguntungkan berdasarkan pengalaman saya. Cuma mungkin kita boleh tunggu harga turun sedikit selepas ini untuk membeli. Atau jika ada yang nak menjual dengan harga yang murah, apa lagi, sambar je....

Subscribe to:

Posts (Atom)